"The decision to conduct an IPO is a turning point in the life of a company because it means transitioning to a fundamentally new model of governance characterised by a significant increase in the role of various groups of stakeholders"

Part 4. CORPORATE GOVERNANCE

Nowadays there are no longer any doubts about the importance of such aspect of the issuer's life as the corporate governance – the improvement of corporate governance practices is high on the agenda of many Russian companies 1. One of the key events in 2013 was the development of a new Corporate Governance Code (hereinafter, the Code) 2, which, being the guide for best standards and practice, was intended to help Russian companies move to a new level of corporate governance and increase their attractiveness in the eyes of local and foreign investors. On the whole, the Code is recommendatory; however, its separate principles and provisions were included to the order issued by the Federal Service for Financial Markets (FSFM) in the form of requirements that must be complied with for the stocks to qualify for the First and the Second quotation levels. The Listing Rules 3 сalso contain requirements set by the order and, given the powers vested in the exchange and based on global best practice, supplement and elaborate these norms. This framework was used to establish corporate governance requirements for stocks to be included in the Second quotation level, and to articulate criteria of independence for members of the board of directors.

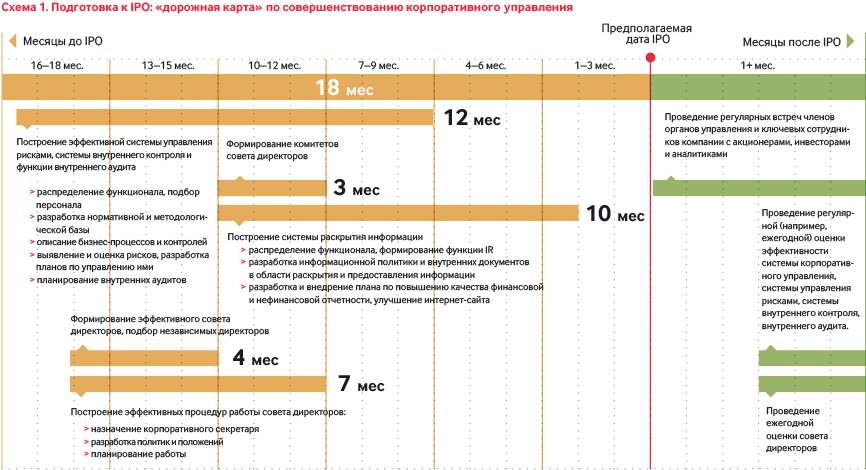

Bringing corporate governance in line with the Listing Rules and best practice is an essential step in the preparation for an IPO, and it involves the establishment of key governance bodies (first of all, the board of directors) and functions (such as an internal audit, and IR), putting in place effective procedures for their operation, and the establishment of various systems (risk management, internal control, etc.). The corporate governance improvement efforts do not stop once an organisation becomes public; on the contrary, an IPO injects new momentum to such activities, shifting the focus to deeper engagement with shareholders and other stakeholders, optimising the operational efficiency of the board of directors, corporate governance reporting, etc.

The practical guidance contained in this part is not restricted to the regulatory requirements and the Listing Rules 4, but is also based on the best practice of corporate governance and, hence, is intended for organisations committed to adhering to the highest standards. The part contains references to a number of studies in the field of corporate governance 5.

The decision to go public is a turning point in the life of any company, since it means the transition to a fundamentally new governance model with various groups of stakeholders (first of all new shareholders and investors) beginning to play a much more important role.

chart 1 Preparing for an IPO: roadmap for corporate governance improvement 6

Chapter 1. Russian Regulatory Environment in Field of Corporate Governance

The status of becoming a public company impacts all aspects of an organisation's operations, because along with this status an organisation attains not only shareholders, but an entire range of obligations too. This chapter contains an overview of various aspects of corporate governance regulated by Russian Law, the Listing Rules, and the Corporate Governance Code.

1. Shareholder rights

Russian Law give shareholders, including minority ones, a wide range of rights to participate in a company's management and to impose clear rules of convening, preparing for, and holding the General Meeting of Shareholders. Some issues not regulated by the Law on Joint-Stock Companies are covered in the Code (for example, the inadmissibility of participation of "quasi-treasury" stock in a company's management). The Code also recommends companies to adopt stricter requirements (in line with best corporate governance practice) relative to the requirements of the law. Some of these guidelines from the Code were incorporated in corporate governance requirements contained in the new Listing Rules 7.

There is a special issue related to shareholders right to participate in profit. In accordance with the new Listing Rules , if shares are to be included in the First Level, it is necessary to define the issuer's dividend policy as approved by the issuer's board of directors. A detailed practical guide on dividend policy is available in the Code (including the recommendation to establish a procedure for determining the minimum share of the consolidated net profit to be distributed as a dividend).

2. Board of directors 8

The board of directors is the lynchpin of a company's corporate governance, overseeing the general supervision of its activity. That is why matters relating to the role of this body, its composition and structure, and operations etc. require heightened attention.

The Joint-Stock Company Law defines the main duties the board is responsible for, sets out the requirements as to the composition of the board, defines the functions of the chairman, and establishes guidelines for the format and procedure of preparing and holding board meetings, etc. However, some crucial issues are addressed in the Code in the form of guidelines on establishing a balanced board, its role in the company's management system, structure, composition and role of board committees, organisation of activity of the board, evaluation and improvement of its performance, as well as remuneration of the board members. The Code provides practical guidance on how the board of directors should go about its key functions, and offers specific tools and mechanisms that should be used. Some issues related to the election of independent directors and establishing committees are also addressed in the Listing Rules.

3. Risk management, internal controls and internal audit 9

The risk management system, internal control system and internal audit function are certainly important elements of corporate governance. However, the issues relating to their design and operation are not addressed by existing law. The Code, on the contrary, pays a lot of attention to those issues. Besides, the Listing Rules compel a company to have a business unit to perform internal audit functions, which must be of a sufficient standard for the stock to qualify for inclusion in the First and the Second levels.

4. Disclosure 10

Statutory disclosure of a company's activity is governed by federal law, including:

- Federal Law No. 39-FZ "On the Securities Market" dated 22 April 1996;

- Federal Law No. 208-FZ "On Joint-Stock Companies" dated 26 December 1995;

- Federal Law No. 208-FZ On Consolidated Financial Statements dated 27 July 2010;

as well as Regulations on the disclosure of information by issuers of equity securities.

In addition, the Code contains a list of recommended additional disclosure, including that on the company, structure and practice of corporate governance, financial performance and financial standing, capital structure, social and environmental responsibility, as well as a list of additional information recommended to be included in the annual report (in addition to the statutory disclosure).

5. Significant corporate actions

Significant corporate action that has or may have a major impact on the capital structure and financial standing of a company and, subsequently, the shareholders, include:

- reorganisation;

- acquisition of 30% or more voting stake (takeover);

- material transactions;

- increase in registered capital, stock split, consolidation and conversion;

- Listing and Delisiting

Law alone cannot provide full protection of shareholders' rights in the event, for instance, if the company takes a significant corporate action. For that reason, the Code recommends a number of additional measures aimed at protecting the rights and legal interests of shareholders with respect to specific significant corporate actions, as well as the following general guidance:

- the board of directors should play a key role in passing resolutions or making recommendations relating to significant corporate action; for that purpose, it should rely on the guidance of the company"s independent directors;

- the company should have in place significant corporate action procedures so that shareholders have access to full information on such actions, have the ability to influence them, and guarantees to adequately protect their rights in the course of taking such action;

- rules and procedures related to the execution of significant corporate action by the company should be set out in internal documents;

- disclosures of significant corporate action should include reasons behind such action and the consequences of such action.

Chapter 2. Preparation for Going Public in line with Expectations of International Investment Community

The decision to go public is a turning point in the life of any company, since it means the transition to a fundamentally new governance model with various groups of stakeholders (first of all new shareholders and investors) beginning to play a much more important role. The status of becoming a public company not only compels a company to bring its corporate governance policies, procedures and practices in line with the standards set for law, regulators, the Exchange, and best practice, but it also brings about a change in the company's mindset in that you cannot act without considering the market reaction and your ability to explain your every step of your decision.

This chapter contains practical guidance on building effective corporate governance systems and processes based on best standards, tendencies and practice.

1. Establishing board of directors, electing independent directors

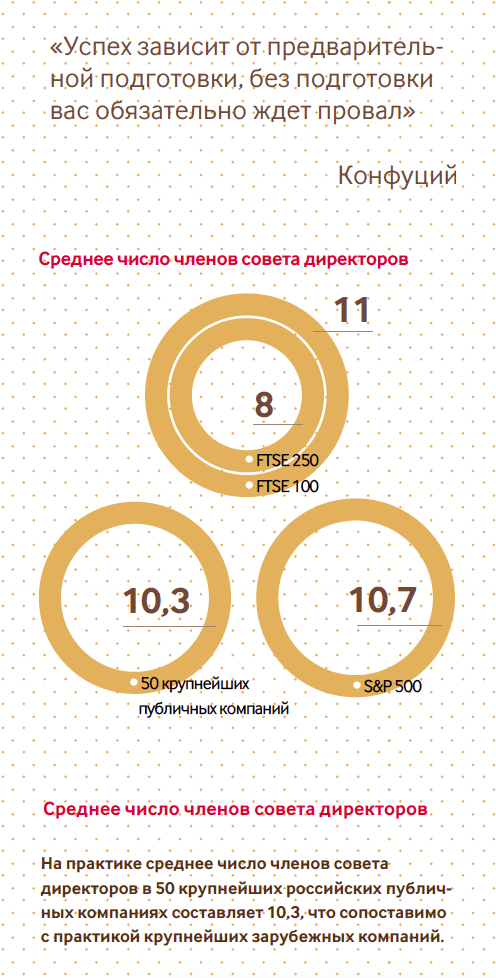

Size matters

According to the Code, the number of board members should be sufficient to organise the activities of the board in an efficient manner, including the potential to set up board committees, as well as providing significant minority shareholders with an opportunity to elect candidates of their choice to the board. The optimal board size will vary depending on the nature and business of a company, and it can be expected to change over time as your business grows.

Board independence

Although Joint-Stock Company law limits the share on the board consisting of the sole executive body and members of the collegial executive body to a quarter of the members, it cannot unconditionally guarantee that the interests of all shareholders will be met. Independent directors are also required for a more efficiently run board of directors.

Requirements and guidelines regarding the number of independent directors

| Listing Rules | The Code guidance | |

|---|---|---|

| First level | Second level | |

| At least 1/5 of the board of directors and no less than 3 | At least 2 | At least 1/3 of the board of directors |

The criteria used by companies to determine the independence of board members are of great importance. The new Code defines expanded and supplemented criteria which are comparable to, or often more stringent than, the criteria applied in global best practice; this forms the basis of the independence criteria contained in the new Listing Rules.

The objectivity of the board and its independence from the management can be enhanced further by separating the functions of the chairman of the board and the executive management functions, as well as the election of an independent board chairman.

Balance of knowledge and experience

To excel, the board of directors should have a balanced composition, including the right mix of competency, experience, knowledge and business acumen. Also, the board of directors should unquestionably enjoy the trust of shareholders. Therefore, the Code recommends that board members should be elected from reputable persons with impeccable business, possessing the required knowledge, skills and experience to fill the role as well as decision-making competency to effectively discharge the functions of the board of directors.

Time resource

The ability of board members to effectively and efficiently perform their duties and devote sufficient time to the company's affairs should be a prerequisite; but, when directors serve on too many boards, it has the potential to become burdensome and adversely affect their performance. Therefore, the best practice includes certain standards relating to the combination of roles and duties held by directors 11.

2. Setting up Board Committees

Structure of committee

According to corporate governance best practice, boards of directors should establish various committees for preliminary consideration of the company's most important activities; this certainly contributes to a more thorough study of the issues and helps produce more balanced decisions.

In accordance with the Listing Rules the following committees are required for inclusion in the First Level:

- Audit Committee;

- Remuneration Committee;

- Nominating Committee (HR, appointments)12.

Inclusion of shares in the Second Level requires just an Audit Committee.

Composition of committees

The composition of committees should be determined in such a way as to enable a thorough discussion of preliminary issues taking into account different views. The key role in the operation of board committees is given to independent directors. Committees should be built, first and foremost, on the basis of professional experience, expertise and skill to enable them to make a significant contribution to the work of the board and the company.

The Code allows committees, if applicable, on a temporary or permanent basis to seek the advice of experts and consultants who do not have voting rights with regards to decision–making on issues relevant to the committee.

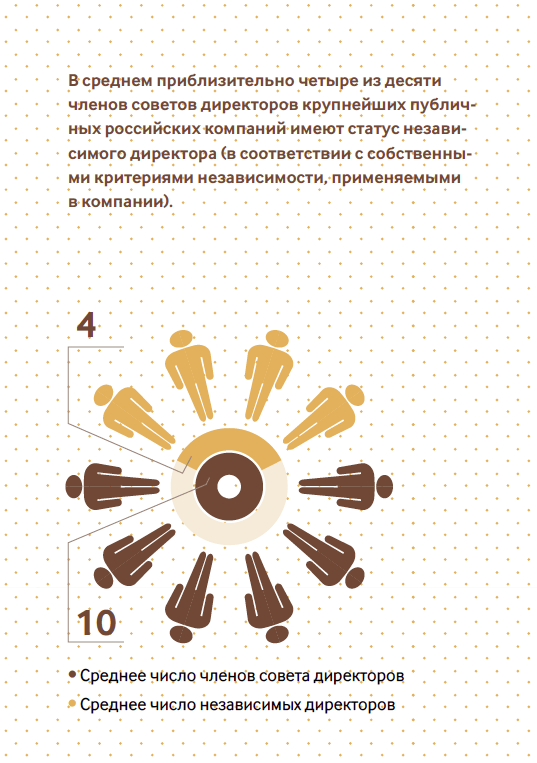

On average approximately four out of ten board members of the largest public companies in Russia have an independent director status (according to the independence criteria applied in the company).

- The average number of board members

- The average number of independent directors

Requirements and guidelines regarding the composition of board committees

| Listing Rules | The Code guidance | ||

|---|---|---|---|

| First level | Second level | ||

| Audit Committee | Independent directors only 13 Independent committee chairman | Independent directors only 14 Independent committee chairman | At least 3 board members At least one independent director with experience and knowledge in the area of preparation, analysis, evaluation and audit of accounting (financial) statements |

| Remuneration Committee | Independent directors only 11 | - | At least 3 board members Independent directors only Independent committee chairman who is not the board chairman |

| Nominating Committee | Independent directors only 11 | - | At least 3 board members Mostly includes independent directors |

3. Implementing effective Board operating procedures

It is not enough to simply establish a Board with a strong composition that gives comfort to shareholders, but at the expense of efficiency; you have to put in place effective operating procedures for it and disclose information.

Effective work planning

The board"s work planning should be driven by the need to perform key functions while taking into account the scale of activity and the challenges facing the company at a given point in time. It is generally considered a good practice to hold board meetings at least once every two months, including personal sessions to explore the most important issues at least on a quarterly basis. Such recommendations have certain rationale behind them – they are related to an objective cycle of planning, monitoring and reporting across the company; the observance of these standards is important for the shareholders, since it is a sign that the board keeps its finger on the pulse and is actively involved in the company's affairs.

Efficient and transparent decision-making

It is important for shareholders to understand how and why the board makes certain decisions. Shareholders (and, first of all, minority ones) want the decisions to be made taking into account to the maximum extent possible the views of all board members (including independent directors and representatives of minority shareholders), because this, to a certain extent, guarantees that the adopted decisions meet the interests of the company and its shareholders. Thus it is recommended to make decisions on critical company matters by a qualified majority of at least three quarters of the votes of the board members. In addition, shareholders should be able to read, upon request, minutes of the board meetings, which should set forth not only the decisions made, but also the course of the discussion, as well as the views of the board members on the issues included on the agenda.

4. Putting in Place an Effective Risk Management System, Internal Controls and an Internal Audit Function

In recent years, especially after the financial crisis, risk management has come into the spotlight, attracting the attention of the investment community and becoming crucial for companies amid widespread criticism of management and the boards over the low awareness of the risks companies take. All this inevitably hits stock valuations in the market. Moreover, domestic companies pay a risk premium (in the form of a discount to global peers) for the increased risk perception still associated with doing business in Russia.

A robust system of risk management and internal control (including a compliance system) is necessary to build shareholders and investor confidence if the goals set out by the company are to be achieved. Today when companies are developing a risk management and internal control system they may opt for a proven concept 15. The risk management and internal control system should cover all spheres of the company's business and be integrated into all business processes. The executive management is responsible for its functioning, while the board of directors should determine the level of risk that an organisation is prepared to accept (risk appetite), core principles and approaches to organisation of the risk management and internal audit system, ensure a regular performance assessment and report on the results of such evaluation as part of an annual report.

To provide to the board of directors and the shareholders assurance in the effective functioning of the system of risk management and internal control, its performance evaluation should be carried out by an independent party. To this end, the company should set up a business unit performing the functions of internal audit and reporting directly to the board of directors. The relevant requirements are set in the Listing Rules for the inclusion of shares in the First and the Second levels. When developing an internal audit function, companies should be guided by generally accepted internal audit standards 16.

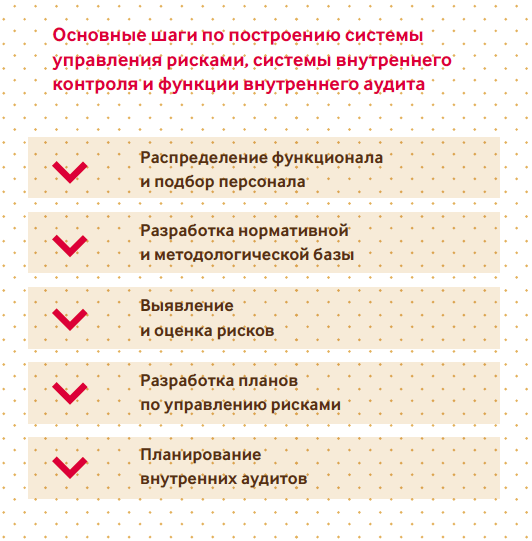

As it may take longer than one year to put in place an effective risk management system, internal controls and an internal audit function, a company should start addressing these issues well in advance, so that by the time of IPO at least basic steps are completed (please refer to the chart above).

5. Improvement of Information Disclosure Transparency

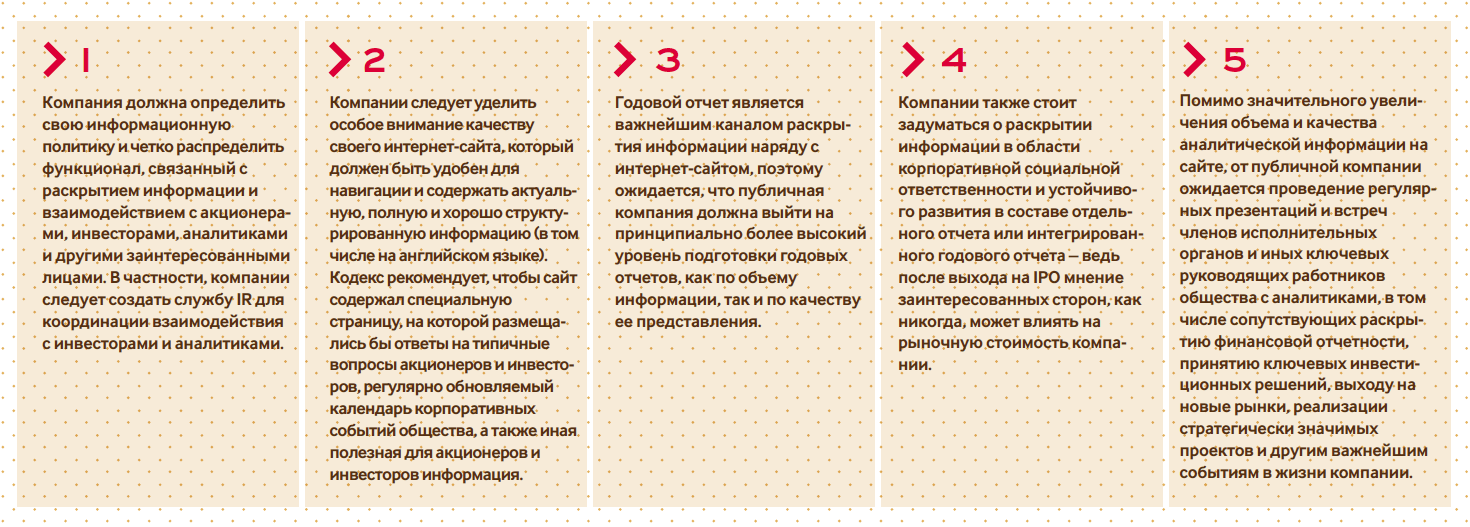

When going public, the most significant progress a company demonstrates is perhaps in the area of information disclosure, as the public status requires maximum transparency in anything related to the company's affairs and which might in any way impact its performance. Transparent disclosure of information influences the perceptions of shareholders, investors, regulators, analysts and the wider public about the company.

It is not only about the need to comply with statutory disclosure requirements in the form of quarterly reports, communication of significant facts, consolidated financial statements, etc., for investors it is important that the company avoids a formal approach to disclosing information and is guided by the principle of transparent disclosure of significant information about its activity, even if the publication of such information is not prescribed by law.

Based on the Code guidance, and the best practice of domestic and foreign companies, we address below main steps that a company is expected to take in the run up to an IPO and immediately after it.

Chapter 3. Maintaining High Corporate Governance Standards Post IPO

Putting in place effective systems and processes in the run up to an IPO, to which the Chapter "Preparation of a company going public in line with the expectations of the international investment community" of this Section is dedicated to, is an essential prerequisite for a successful floatation; however, it is not enough to build future success. The company's life after an IPO comes under the close scrutiny of the investment community, market regulators mass media and the wider public; therefore, the company needs to exercise the utmost care to monitor each element of its corporate governance system if it hopes to achieve ongoing improvements and meet constantly growing market demands.

The board of directors plays a key role in maintaining high standards of corporate governance. The chapter "Preparation of a company going public in line with the expectations of the international investment community" of this Section has already covered issues related to the board"s duties to maintain high standards of information disclosure, exercise control over the executive management, ensure effective operation of the risk management system, internal controls and an internal audit function. This chapter deals with effective communication between the board and shareholders, the role of independent directors, the board performance assessment, and reporting on the company's corporate governance practice.

1. Effective Communication between the Board and Shareholders

The board of directors should be accountable to the company's shareholders; therefore, information on board activity should be regularly disclosed and reported to shareholders.

The Code recommends that the key results of the board and executive management performance assessment should be disclosed in the annual report and on the company's website. Such information includes:

- information on the board"s role in the organisation of an effective risk management and internal control system

- information on the number of board and board committee meetings held during the previous year, specifying the meeting format and details of board members attendance

- Information on decisions taken during the reporting year to prematurely terminate the powers of the company's executive bodies, and the reasons behind such decisions.

Shareholders find it important that the Chairman of the board and the board members (including independent directors) are available at all times for communication. Shareholders should be able to direct questions to the board chairman on issues within the board"s competence at any time, and communicate points of view on such issues, for example, face-to-face or via a corporate secretary 17. Finally, it is important for shareholder to be able to obtain comments from board members regarding recommendations and conclusions submitted to the general shareholders' meeting; as a result, it is recommended that such individuals are invited to attend the general meeting.

2. Role of independent directors

For the board of directors to effectively perform its functions, including those related to the protection of shareholder interests, there should exist "checks and balances" at the board level achieved first of all by inclusion to the board of independent directors. The presence of independent directors in the board boosts investor confidence in the company, as it means, in fact, that the board is able to make objective judgements on the issues considered and make decisions in the interests of the company itself and all of its shareholders.

Independent directors are expected to make a significant contribution to the discussion and adoption of decisions on important issues that might affect the shareholders, including:

- formulating the company's development strategy and assessing whether the company has alignment between its operations and strategy;

- preventing and resolving corporate conflicts;

- assessing the performance of executive bodies;

- assessing the company's performance in terms of meeting the interests of all shareholders;

- disclosing reliable information on the company's performance in a timely fashion;

- the company's reorganisation and share capital increase;

- introducing significant changes to the company's incorporation documents which affect shareholders" rights;

- issues related to the company's takeover procedures, etc.

Finally, as already mentioned, independent directors should play a leading role in the board committees' activities.

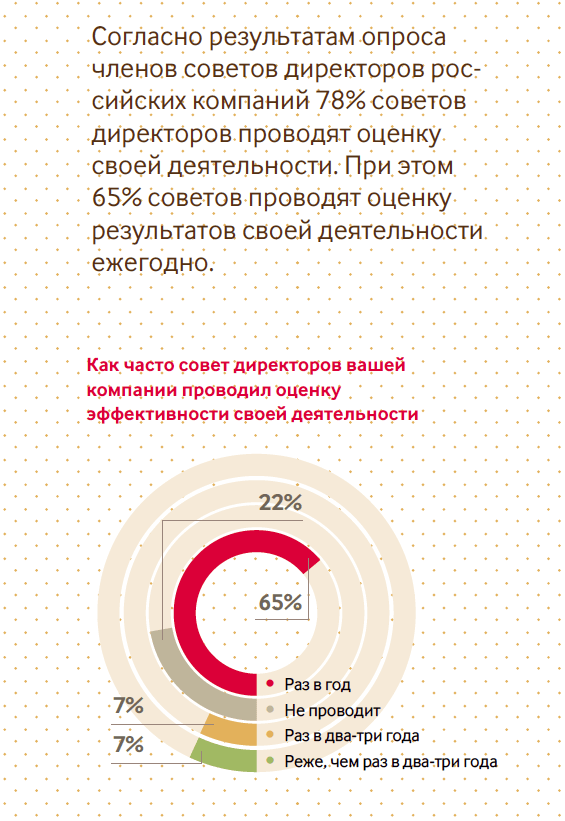

3. Board performance evaluation

It is a long time since best practice introduced the requirement that the board should regularly assess its performance and look for ways to improve its operations. If the board performance assessment process is organised effectively and efficiently, its outcomes might be useful for planning the board succession, and for training and developing the board members. The Code recommends that the performance assessment of the board of directors, the board committees and the board members should be conducted on an annual basis, with the engagement of a third party organisation (a consultant) at least every third year.

The survey of the board members of Russian companies showed that externally-facilitated independent board evaluations are conducted in 20% of companies; among UK companies, this figure stands at 13% and among S&P 500 companies – at 19%.

4. Reporting on a Company"s Corporate Governance Practice

According to the Code, companies should disclose information about their system and corporate governance practice, including detailed information on the observance of the principles and recommendations of the Code itself. Complete and unbiased disclosures about the corporate governance practice and its compliance with applicable standards is essential to build and maintain sustainable trust with shareholders, investors and other stakeholders (partners, customers, suppliers, wider public, market regulators and the government). Furthermore, in the long term, it contributes to the company's value enhancement and makes it easier to raise additional capital.

To avoid a formal approach to reporting on compliance with the Code, the company should focus on instances of non-compliances with specific principles and recommendations of the Code and provide explanations of causes and the consequences of such non-compliance, describing the progress made in the development of the corporate governance practice, and planned steps to make further improvements.

- According to researches, the quality of corporate governance is one of the key non-financial factors driving the market value of public Russian companies. Such researches include: Corporate Governance: Price of Additional Risks (Aton, 2012); Emerging Market IPOs: Investor Perceptions and IR Considerations (BNY Mellon, 2010); The Governance Alpha: Back-Testing the Correlations of S&P"s Governance Scores with Corporate Performance (Russia and Kazakhstan, 2000-2009) (Standard & Poor"s, 2010)

- Included on the agenda of the Russian Government meeting on 13 February 2014 and approved by Resolution of the Board of Directors of the Bank of Russia on 21 April 2014

- Full name – Listing Rules of CJSC MICEX Stock Exchange (registered by the Bank of Russia on 8 October 2015, came into force on 19 October 2015).

- Please see the Part Listing Rules с– international best practice" for main Listing Rules requirements".

- Such researches include: Russian boards: selection, nomination and election survey (PwC Russia, 2012); Setting the tone from the top: Russian boards survey (PwC Russia, 2013); Non-executive director survey (PwC UK, 2011); Spencer Stuart Board Index (2013).

- These dates are indicative and depend on individual company, the scale of its business and the level of maturity of corporate governance.

- Including the requirement for an issuer to have in its incorporation documents provisions that a notice of GSM should be given at least 30 days before the meeting, and that the information on the date of making a list of persons entitled to attend the shareholders' meeting is to be disclosed not later than 7 days before such date.

- Matters relating to the establishment of the board of directors, election of independent directors, establishment of board committees, introduction of the corporate secretary institution, putting in place effective board procedures and controls over the company's operations and the executive management are addressed in detail in Chapter Preparation for Going Public in line with Expectations of International Investment Community of this Part. Matters relating to an effective collaboration between the board and shareholders, the role of independent directors, evaluation of the board performance, succession planning in the board are addressed in detail in Chapter Maintaining High Corporate Governance Standards Post IPO of this Part.

- Matters related to putting in place an effective risk management system, internal controls and an internal audit function are addressed in detail Chapter Preparation for Going Public in line with Expectations of International Investment Community of this Part.

- Matters related to improvement of disclosure standards are addressed in detail in Chapter Preparation for Going Public in line with Expectations of International Investment Community of this Part.

- For example, according to the ISS Corporate Governance QuickScore methodology, non-executive directors are allowed to combine 1) seats on boards of directors of no more than 5 companies (the total upper limit), or 2) no more than an executive director position in one company and non-executive director positions in two companies, or 3) the board chairman position in one company and non-executive director positions in three companies. The board chairman is allowed to hold an additional position of the board chairman in one company and non-executive director positions in three companies.

- In fact the Listing Rules contain two lists of director independence criteria: those that will be applied till 1 July 2017, and those that will come into force on 1 July 2017 (the latter are extended criteria, harmonised with the recommendations with the Code).

- If this is impossible due to objective reasons, the majority of the committee must be made up of independent directors, and the other members of the committee might be represented by the board members who are not the sole executive body and/or members of the collegial executive body of the issuer.

- If this is impossible due to objective reasons, the audit committee might be made up of the board members who are not the sole executive body and/or members of the collegial executive body of the issuer.

- The Listing Rules permit that the functions of the remuneration committee and the nominating (HR, appointments) committee might be performed by one and the same committee.

- These include: COSO Internal Control – Integrated Framework, Enterprise Risk Management – Integrated Framework (COSO), Treadway Commission Sponsor Organisations Committee; International Standard ISO 31000 Risk management – Principles and guidelines, International Standard ISO 31010 Risk management – Risk assessment techniques

- In particular, The International Standards for the Professional Practice of Internal Auditing of The Institute of Internal Auditors

- An individual/business unit performing the functions of a corporate secretary is one of the Listing Rules requirements for the stock to qualify for the First Level