"For a company and its shareholders an IPO is a natural evolutionary stage which creates new impetus for future business development and transparency"

PART 1. KEY STEPS TOWARDS PREPARING AND LAUNCHING AN IPO

Chapter 1. What Is an IPO?

An IPO is an initial public offering of a company"s stocks to a broad investor community, which involves establishment of listing and initiation of trading on a stock exchange. Following an IPO, the issuer obtains a floatation of its stock and publicly-available real-time market quotes: the company becomes public.

The first references to a public offering mechanism date back to Ancient Rome. The twentieth century saw demand for IPOs skyrocketing against the backdrop of an expanding global economy and faster communication. An IPO is now seen as a milestone in the development of many corporates. The global IPO market reached a record USD373 billion in 2007 and amounted to USD195 billion in 2013.

Commonly, a successful IPO is preceded by extensive preparations – costly and time-consuming, aiming to have the company meet best market practice, appreciated by a broad investor community. The preparatory stage will also include presentations and information disclosure.

I. Why Go Public?

An IPO represents a logical growth stage for a company and its shareholders: it serves to create further momentum for development and to improve the transparency of the existing business structure. Going public entails multiple changes in the established approach to operations and management. When launching an IPO, companies normally look to achieve one or more of the following goals:

- To raise additional capital for the company from a wide range of investors;

- To obtain fair market valuation for the assets;

- To add liquidity to the assets of current shareholders;

- To give current shareholders an opportunity to monetize (fully or partially) their holdings in the company;

- To make the company"s shares publicly traded and subsequently acceptable as M&A currency;

- To improve corporate governance and transparency in the company, and to establish comprehensive management control mechanisms;

- To implement management incentive programmes;

- To curb the cost of borrowing.

Chapter 2. IPO Success Factors

The issuer"s preparation work is key to conducting a successful IPO: the company assesses expected benefits from the placement and the required business resources for the project completion, and implements internal changes that are necessary to be publicly traded. Preparations normally start well ahead of the offering itself and continue until the project is completed.

The key success factors of an IPO include:

-

Appealing equity story:

- Growth / cash flow generation prospects;

- Clear and achievable development strategy;

- Seasoned and strong management team;

- Strong positioning versus competitors.

-

Issuer"s "homework":

- Available audited financial statements for the previous three years;

- Transparent legal ownership structure;

- Consolidation of all existing profit centres and cash flows;

- High standards of corporate governance;

- High standards of information disclosure;

- Engagement of an effective pool of banks to manage the IPO;

- Engagement of other professional advisors (auditors, legal counsels, PR agent, etc.);

-

Elaboration of most appropriate structure and key parameters of the offering:

- Suitable timing for launching the IPO;

- Offering size;

- Primary / secondary components split;

- Size of the retail placement tranche (if any);

- Post-IPO lock-up period;

- Possibility of offering shares in the US under the 144A regulation;

- Price stabilisation mechanism (greenshoe).

-

Effective preparation process:

- Competent day-to-day project running and documentation drafting together with other engaged professional advisers;

- Obtainment of required regulatory approvals and consents;

- Listing on Moscow Stock Exchange;

- Presentation of the corporate equity story to a broad investor community;

- Post-IPO research and secondary-market support.

Effective IPO preparations require the advisory support of independent financial advisers and cooperation with Moscow Exchange.

Chapter 3. Optimum IPO Structure

The optimal offering structure is crucial for the success of the IPO, but it is important that it can be re-adjusted in the course of preparing for the offering based on investor feedback and existing equity market environment. As an example, the overall offering size or its primary component can be revised upward.

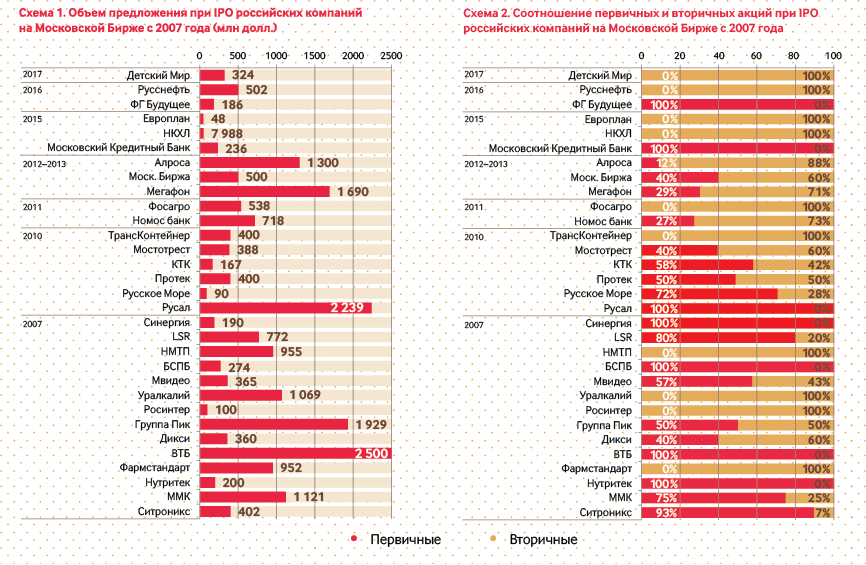

The effective offering size depends on the expected asset valuation, the market"s ability to digest the proposed amount, and the minimum liquidity level required by investors. Historically, IPOs on Moscow Exchange have varied from RUB3 billion to more than RUB270 billion.

The free-float is a function of the offering size and the company"s valuation, but a Moscow Exchange listing will require the free-float to make up at least 10% of the company"s total outstanding shares. The free-float includes IPO stocks plus minority non-strategic shareholdings, not subject to post-IPO lock-up.

The larger the offering and the free-float, the better the stock liquidity, which implies faster turnover, greater stock supply on the market, and eventually – all other things equal – higher market valuation.

Another important aspect of the offering is the primary / secondary split, i.e. the proportion of newly-issued shares and existing stocks to be sold by current shareholders, which is subject to the company"s requirement of additional capital and its development goals.

Historically, IPOs on the Russian equity market include both primary and secondary components with their ratio averaging 50/50 since 2007.

Chapter 4. Key Parties and Work Streams in IPO Preparation

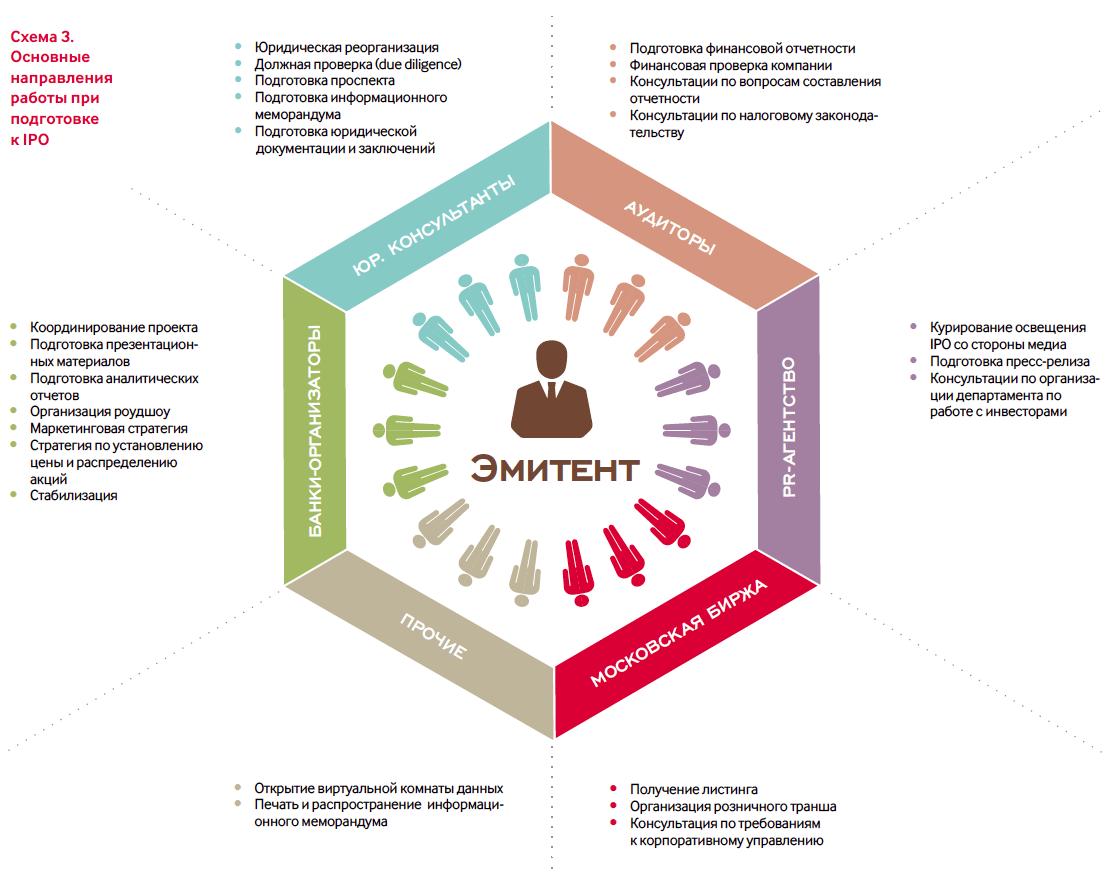

IPO preparation and implementation is a complicated process, demanding coordinated efforts of multiple parties.

The company"s management play the pivotal role in IPO preparation: they are responsible for the appointment of the banks" syndicate and other advisers, for internal corporate improvements; provide information for due diligence, for preparation of the offering prospectus and marketing materials; navigate external communications, and operate as ultimate decision-makers.

Investment banks / bookrunners manage the project on daily basis, advise on the deal structuring, and coordinate preparations for the IPO, including the following:

- Due diligence;

- Prospectus and information memorandum drafting;

- Preparation of marketing materials;

- Elaboration of equity story;

- Business valuation;

- Arrangement of the management roadshow

- Collection of investor orders;

- Advisory support in pricing;

- Settlements between investors and the issuer/shareholders.

Legal counsels provide legal support and play the main role in legal due diligence, drafting of the IPO prospectus and information memorandum, and preparation of other agreements and opinions.

Auditors take care of financial statements, advise on financial disclosure and audit issues, and prepare the comfort letter.

PR agent undertakes liaison with the media in the context of the offering and subsequent IR events.

Financial printers set up printing and distribution of the information memorandum (its preliminary and final version).

Chapter 5. IPO Process

1. Optimum timing for the offering

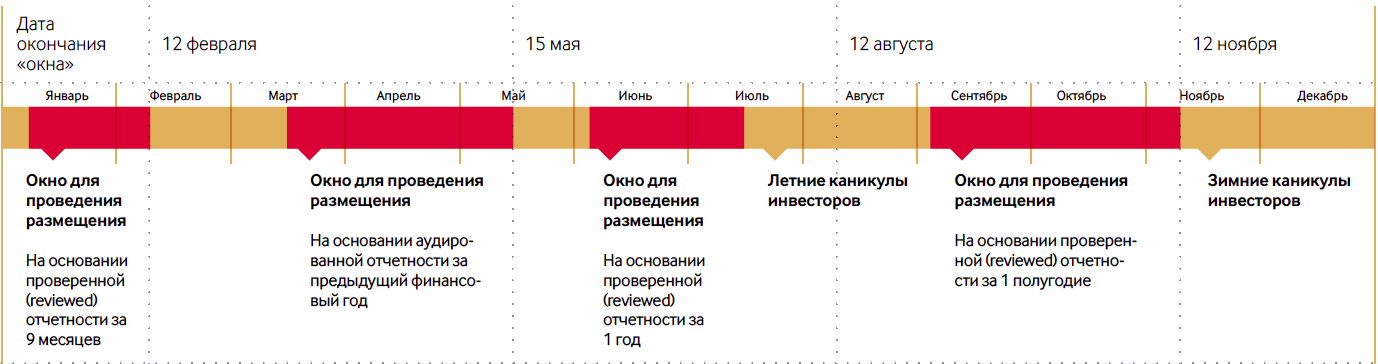

There are four traditional IPO windows (see Chart 4).

The auditor"s opinion is usually provided for financial statements issued for the period ended 135 days earlier maximum: this places restrictions on the available timing windows for the share placement. Respective deadlines for 135 days" old financial statements fall on 12 February, 15 May, 12 August, and 12 November.

In every single case, the IPO timing will depend on the dates when the company"s financial statements are prepared and issued. Fair consideration is normally given to the business cyclicality and equity market environment.

2. Offering preparation schedule

Most active preparations for the IPO launch span from 5 to 7 months, depending on what extent the issuer meets existing investor requirements, while the preliminary stage is sometimes started more than a year before the offering. A well-planned preparation schedule helps save the management"s time and ensures perfect investor contact and feedback.

IPO preparations normally consist of two major parts: the preliminary stage and the public stage, effectively divided by the company"s announcement of its intention to go public(Intention to Float). This announcement triggers extensive coverage of the coming placement in the media with research analysts from bookrunners starting to arrange meetings with investors in order to present independent research outlooks.

Preparation of IPO prospectus

and information memorandum, due diligence

At the preliminary stage, investment banks together with legal counsels and the issuer perform due diligence, prepare the IPO prospectus and information memorandum.

In tandem with its financial and legal advisors, the company prepares the IPO prospectus, containing all the necessary information about the company and describing the transaction structure as required by Russian law. The prospectus is to be registered with the Bank of Russia and represents one of the key documents required for a Moscow Exchange listing.

Looking to attract more shareholders from international markets, corporations also prepare a separate marketing document – information memorandum, providing all the core information about the company for potential investors.

The information memorandum drafting takes up to 10–12 weeks and entails extensive involvement of the company"s management. Preparation of the memorandum is the responsibility of legal counsels bookrunners yet it requires hands-on assistance from management. Please see a detailed description of the information memorandum structure on the page.

Due diligence aims to provide a fair, non-biased view of the company and a clear understanding of its operations. Every party involved in the IPO preparations is responsible for its respective aspect of due diligence: legal counsels verify the good title to business, auditors perform financial due diligence and bookrunners examine the sustainability of operations and conduct multiple stress tests.

Bookrunners thoroughly examine the company of behalf of potential investors, so that they are comfortable about the consistent nature of the company"s business. Information is collected among other things by way of arranging site visits, interviewing the management team, suppliers, and customers.

4. Public marketing

Preparation of marketing materials

The main marketing materials of an IPO are:

- Research report;

- Roadshow management presentation;

- Information memorandum.

Marketing begins with detailed business presentations for independent research representatives of the bookrunners (analyst presentation). Based on the information obtained, research analysts deliver an independent business valuation and provide an investment outlook to be further presented to potential investors.

The intention to float is followed by a research analyst roadshow, involving the publication and distribution of the research report, an independent analytical document.

Of paramount importance for a successful offering are management (and sometimes shareholder) meetings with potential investors, as part of the management roadshow . The roadshow is launched immediately following the announcement of the IPO price guidance and lasts for up to two weeks. One-on-one meetings with investor representatives are aimed at providing a detailed business and strategy presentation, to establish good-natured and solid relationships among stakeholders in the company and its potential future shareholders, and to prove management"s capability to accomplish the company"s mission.

The management team on the roadshow usually consists of the CEO and CFO plus some other key members of the company"s management. In a series of meetings with investors, they represent the company"s equity story. In parallel, bookrunners collect purchase orders from investors.

Following the roadshow the issuer together with shareholders and in consultation with the IPO managers determine the offering price and allocate shares among the pool of investors that participated in the IPO.

From then on, the IPO is successfully completed, and the company turns a new page in its history, becoming a public company.