"The aim of marketing is to inform the broadest possible range of potential investors about the planned offering, which involves actions targeted at the maximisation of demand and creation of price tension among investors in order to reach a maximum offering price."

PART 1. MARKETING STRATEGY

Chapter 1. Introduction

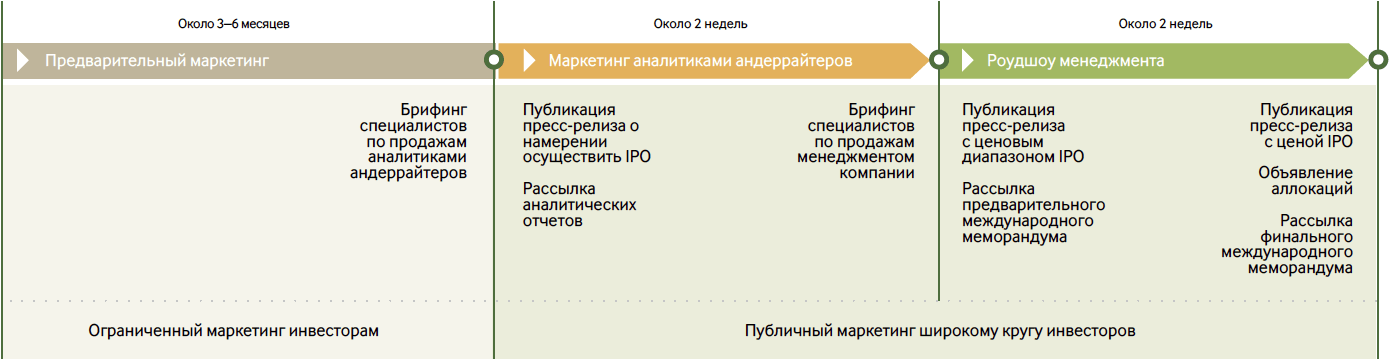

Marketing an Initial Public Offering IPO) is a relatively complex process that can be ostensibly divided into three stages, each one determining subsequent strategy and tactics of cooperation with investors. The marketing strategy outlined in this section is the one most frequently used. However, certain aspects of it remain subject to adjustment depending on the characteristics of the deal.

Basic marketing stages include: 1) the "early-look" conducted before publicly announcing the intention to proceed with the IPO (Intention to float announcement); 2) pre-deal investor education (PDIE) by research analysts upon publication of the Intention-to-Float announcement; 3) the final stage of the IPO, marketing where the Information Memorandum is published, the management roadshow is launched and the bookbuilding is carried out.

Depending on the stock market conditions, the type and size of the offering, and the deal structure complexity the duration of the marketing process may change. Generally, the public stage (the pre-deal investor education and the management roadshow) takes approximately 3?–4 weeks, while the non-public stage of the early-look marketing may take from several weeks to several months.

The aim of marketing is to inform the broadest possible range of potential investors about the planned offering, which involves actions targeted at the maximisation of demand and creation of price tension among investors in order to reach a maximum offering price.

Depending on the deal type, the target group of investors the marketing is directed at may vary. Generally, the marketing is aimed at institutional investors. However, the offering may also be addressed to both institutional and retail investors, including the use of a retail tranche. Therefore, the marketing is organised by the Underwriters in an optimal manner with depending on the particular characteristics of the deal.

Chapter 2. Investors in a Russian IPO

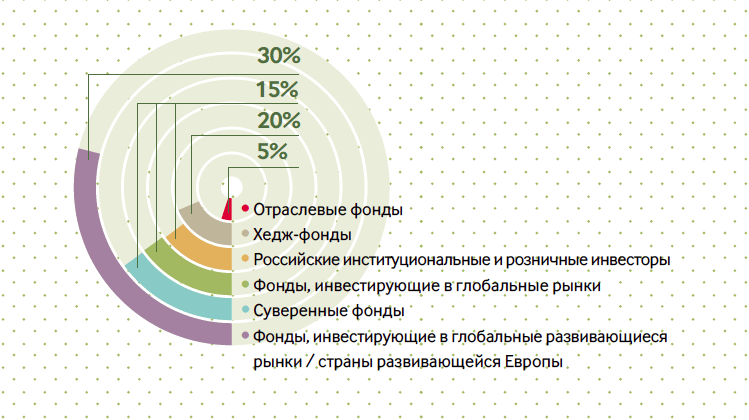

Depending on the company size, industry, offer size, and other specifications of an IPO the list of potential investors may vary — investors apply their own investment strategies and, consequently, have their own investment criteria. Generally, there are several main groups of investors who may be interested in an IPO of a Russian company. However, the lines are blurred in practice.

It is worth noting that the demand structure shown in Chart 2 is indicative and may change depending on the size of the deal, the company, and the industry.

Chapter 3. First Stage: Early-Look Meetings with Investors

The aim of these meetings is to establish dialogue with investors, educate them of the company"s equity story, and get an understanding how they see the company evolving to become a successful IPO candidate. For instance, if a company from a complex industry niche contemplated an IPO, it would possibly require a longer preliminary marketing period to educate investors on the specifics of the industry and to evaluate the potential interest.

The duration and structure of the first stage of the marketing process may vary significantly depending on the particular features of the deal and the issuer.

Key investor groups of a Russian IPO

| Investor Group | Description | |

|---|---|---|

| Russian Institutional and Retail Investors | Generally, this group of investors is the most familiar with the issuer"s equity story. Such investors apply a fundamental investment approach and invest into high-growth companies with a long-term investment horizon. | |

| International Institutional Investors | Global Emerging Markets / Emerging Europe Funds |

|

| Global Funds |

|

|

| Hedge funds |

|

|

| Sector-focused Funds |

|

|

| Sovereign Wealth Funds |

|

|

1. Non-Deal management roadshow

Meetings between management of the issuer and investors during a non-deal roadshow serve as the main tool of preliminary marketing. These meetings usually take place 1–6 months prior to the IPO.

The deal confidentiality serves as a core factor that is taken into consideration when determining the number of investors to approach as part of the early-look marketing.

In certain circumstances, the Underwriters can start dialog with three to five of the most interested investors several weeks prior to the start of the deal to engage in more detailed discussion on possible participation in the offering (so-called Pilot Fishing). If these investors confirm their participation in the IPO they usually receive privileged allocation of shares as an incentive. Within such a dialog framework and depending on the interest level, the investors can be nominally divided into Anchor and Cornerstone investors.

2. Anchor and Cornerstone Investors

The participation of Cornerstone and Anchor investors creates a more positive footing to start the deal on, because such investors commit to submit orders (usually large) prior to the formal launch of the deal, which basically represents pre-guaranteed demand. This often serves as a sign of confidence to other investors.

The involvement of Anchor and Cornerstone investors is not applicable to every deal and depends on the size of the IPO. In general, the participation of Cornerstone and Anchor investors implies a large-size offering.

Successful marketing to Cornerstone and Anchor investors starts with early dialog—usually at least two months prior to the ITF announcement. The communication starts with signing a Non-Disclosure Agreement, and the rest of the process is flexible. Generally, the investor holds one or several meetings or conference calls with the company"s management and sends requests for information in relation to financial and other data to conduct due diligence.

The notion of Cornerstone and Anchor investors is not directly connected to the investment strategy or fund type. Any fund that shows interest in the company and is ready to commit to place an order of a certain size can play this role. The key difference between a Cornerstone Investor and an Anchor Investor is in the form of this commitment. If the investor is ready to sign the Commitment Letter and agrees to a lock-up then this investor is called a Cornerstone investor. The participation of Cornerstone investor"s is usually disclosed in the Information Memorandum. Those investors who are not prepared to sign the Commitment Letter but are ready to verbally commit to place an order of a certain size immediately after the start of bookbuilding at the IPO, price are Anchor Investors.

The benefits of Cornerstone and Anchor investors participating are obvious for an issuer and the Underwriters. In return, those investors receive certain privileges. Cornerstone investors are usually guaranteed to a full allocation. In contrast, the Anchor investors are not guaranteed to get a full allocation but it is not uncommon for them to be in a privileged position as regards allocation comparison to other investors.

Usually, Sovereign Wealth Funds and a number of large long-only funds act as the Cornerstone investors, although there are no formal limitations.

The Anchor investors often include various large funds (both long-only and hedge) that for some reason are not inclined to provide a written commitment to participate in the IPO.

Chapter 4. Second Stage: Pre-Deal Investor Education

As part of an IPO, research analysts prepare a detailed pre-deal research report about the company. After it is distributed a roadshow is organised to meet investors. The geographic coverage of the roadshow depends on the size and structure of the deal. Besides involvement in the IPO, the main responsibility of research analysts is to inform investors who regularly trade with their investment bank of issuer-related newsflow and developments: this includes periodic publication of research reports on the public company, issuing of briefs concerning important news about the company"s business activities, answering questions from investors, and regular roadshows to investors.

Generally, pre-deal investor education by research analysts takes two to three weeks starting from the publication of the ITF announcement and distribution of the pre-deal research reports. It should be noted that over the course of the entire management roadshow, the research analysts continue collaborating with investors with on-demand meeting arrangements and conference calls addressing additional enquiries by the investors.

The objective is for research analysts to educate the widest possible range of investors on the issuer"s equity story and convey his/her independent view on the fundamental value of the company. An important part of the process is collecting investor feedback and their interest in participating in the placement and receiving pricing guidance. Investor feedback enables the management team to be better prepared for the roadshow, and price indications allow an optimal price range to be set for the offering.

1. Intention-to-float announcement press release

The first step of the public stage of an IPO яis the release of a press announcement of the company"s intention to float. The press release includes the intention to go public as well as brief information about the issuer, and depending on the proposed deal, it may also include information on the indicative timing, the listing platform, the indicative size, and other details.

Frequently, the company"s representative gives interviews to business newspapers after the press release is published. The PR/IR department of the company responds to questions from journalists and—jointly with the PR Adviser—tracks possible errors in press publications.

The Underwriters distribute pre-deal research reports to investors on the day of the ITF announcement. The list of investors who receive the report depends on the deal structure. In the case of a Russian company's IPO the report is frequently sent to institutional investors outside of the US, Japan, Australia, and several other countries, with indicatively 2,500–3,000 institutional investors in total.

2. Pre-deal research reports

A pre-deal research report serves as an important marketing document—a source of information about the company and the industry—that includes financial information sufficient to start work on company analysis and a financial model by investors prior to distribution of the Informational Memorandum and the start of the management roadshow.

Investment bankers together with the company"s management prepare the Analyst Presentation, a detailed presentation on the company"s business which serves as the basis for preparation of the pre-deal research reports by analysts. An Analyst Presentation takes place 4-6 weeks prior to the ITF announcement. The introduction of research analysts to the company"s equity story is an important factor, as the deal will later be marketed to the investors by the management team, it is important that the research analysts correctly comprehend the company business practices and evaluate its growth prospects.

During the four- to six-week research report preparation period, on-request conference calls are held for the research analysts where additional information is provided and the analysts" questions are answered. Draft versions of research reports are sent to the company for fact checking. This process is regulated and controlled by the Legal Counsels to maintain the independence of the research analysts" opinion.

The distribution parameters of the pre-deal research reports depend on the deal structure. Upon completion of the distribution, a blackout period on publishing further research reports about the company takes effect for the Underwriters. For European deals, the blackout period lasts for 40 days after the IPO. Determining the duration of the blackout period is a complex issue that depends on various factors and to be determined in consultation with Legal Counsel.

3. Sales briefing by research analysts

On the ITF date, each Underwriter"s research analyst holds a briefing for his colleagues—sales people. As part of the briefing, the research analyst presents key points of the company investment opportunity and provides his/her independent view on the fundamental value of the company.

After distributing the research reports, the sale people make contacts with investors, confirm that reports have been received, describe the proposed deal, inquire about possible questions and requests for a meeting or a phone call with the research analyst, and receive early feedback on the deal.

4. Research analysts roadshow

As part of the roadshow, the research analysts conduct a number of meetings and conference calls with investors to introduce them to the issuer"s equity story.

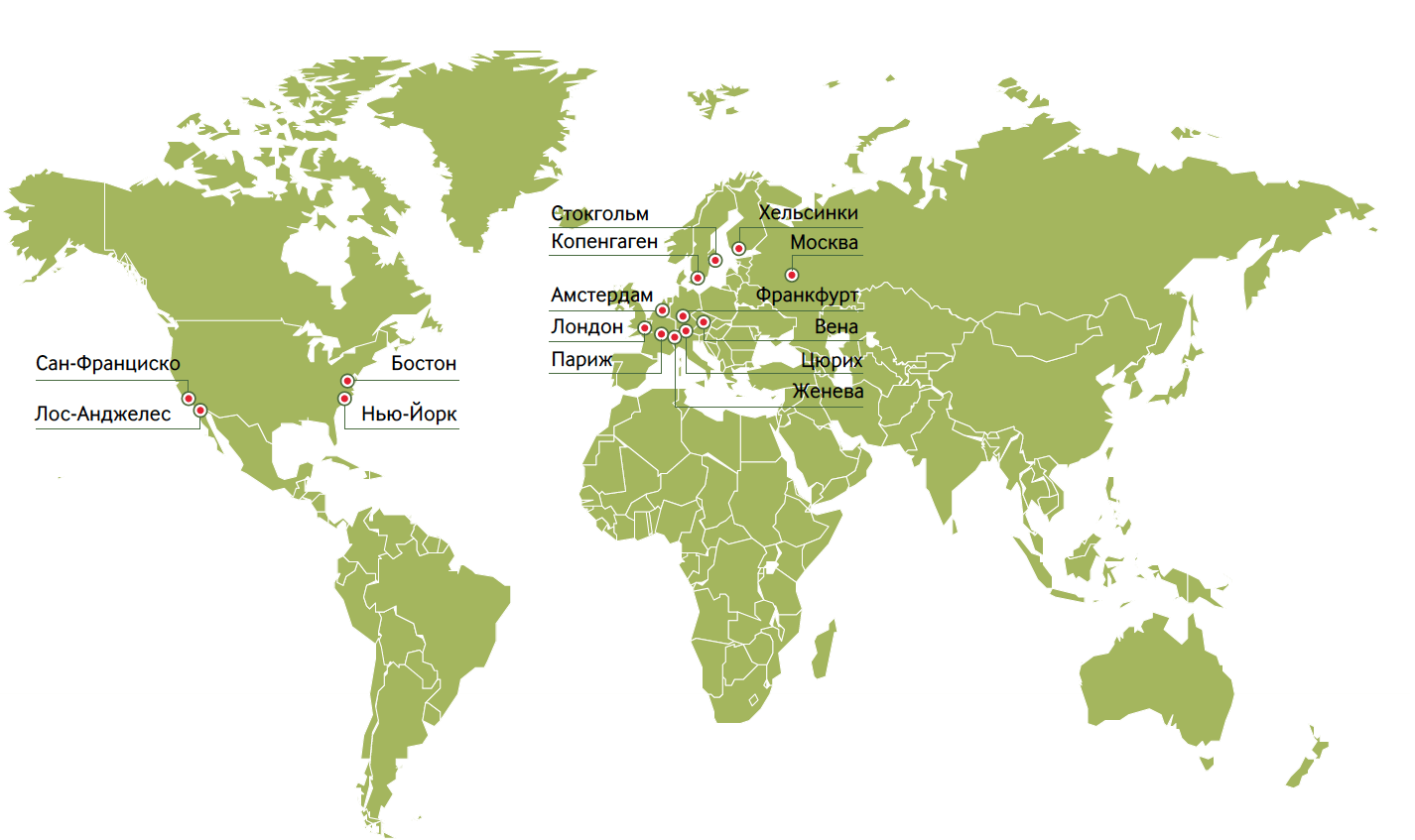

The research analysts" roadshow has a substantially wider geographical distribution than that of the management team. Usually, the meetings with investors take place in key financial centres, including Moscow, London, Frankfurt, Stockholm, Helsinki, Geneva, New York, Boston, and other locations.

During the meetings with investors, the research analyst presents the issuer"s equity story, growth prospects, his/her views on the fundamental value of the company, and potential risks. The research analyst aims to educate investors about the company business, to provide information that is sufficient for the investors to commence their own analysis, and to receive feedback from investors.

After the meetings with the research analysts, the sales people will maintain contact with investors to receive detailed feedback on the IPO, whether they intend to participate, valuation views, possible questions and concerns. This feedback is consolidated, analysed, and subsequently used for the setting the price range, fine-tuning the roadshow presentation, and preparing the management team to correctly answer complex questions.

Whilst investors read the pre-deal research reports and meet with the research analysts, the investment bankers and the management team prepare for the roadshow, including a series of rehearsals of the roadshow presentation by management.

Chapter 5. Third Stage: Management Roadshow

The final and most important stage of the marketing process is the management roadshow. This stage starts with the distribution of the Preliminary Information Memorandum. Concurrently, the press release on the indicative price range for the IPO is being published.

While the marketing by research analysts is aimed at informing investors about the company and the deal, the management team"s roadshow is carried out to convert potential investor interest into actual demand, which is collected via bookbuilding.

1. The press release on indicative price range of IPO

This press release serves as an official signal to investors that the company has set the indicative price range for its IPO, the Underwriters have started bookbuilding, and the management team has kicked-off roadshow.

The press release includes detailed information on the offering, including the indicative price range, estimated offer size, names of the selling shareholders, listing, platform, use of the proceeds (if the issuer attracts funds), the lock-up and other details.

Frequently, a company representative gives interviews to business newspapers after the press release is published. The company"s PR/IR department responds to questions from journalists and—jointly with the PR Adviser—tracks possible misstatements in press publications.

2. Preliminary Information memorandum

The Information Memorandum serves as the main marketing document and includes detailed information about the company, its strategy, the sector it belongs to, its business risks, information about the offering and the selling shareholders, management discussions and analysis of the financial results, as well as audited historical financial statements. The size of the Information Memorandum is around 300–500 pages.

This document is prepared by the issuer"s Legal Counsel with active participation of the issuer"s management, the Underwriters, the Auditors, and the Underwriters" Legal Counsel (more on this under the link).

The type and the geographic distribution of the investors who receive the Information Memorandum depend on the deal structure. Usually, the Preliminary Informational Memorandum is distributed to all investors who have received the pre-deal research reports as well as to all other potential investors interested in participating in the deal (for instance, eligible institutional investors in the US, Canada, and Japan).

In most cases, the Preliminary Information Memorandum differs from the Final Information Memorandum by not containing the offering price and related information in respective sections.

3. Roadshow presentation

The roadshow presentation is the main marketing document used by the management team to present the company"s equity story to investors. There is flexibility as regards the content of the roadshow presentation whilst all the information presented in the document must be in accordance with the Information Memorandum.

Usually, the body of the presentation describes key investment highlights (10–15 slides), whilst more detailed information can be found in the appendix which serves as a reference when answering the investor questions (15–25 slides).

The preparation of the Roadshow Presentation is carried out by investment bankers with the involvement of the company"s management and Legal Counsel. Usually, the preparation takes from one to several months to prepare. Its final stage includes a series of rehearsals to prepare the management team for the roadshow.

Arrangement of secure online access to the Roadshow Presentation for institutional investors is a common practice in international offerings. During the management roadshow, an investor with login details has the opportunity to access the presentation used by the management team for marketing the deal. Often, the online presentation is complemented by the management team"s audio commentary recorded in advance.

4. Sales teach-in by management

On the first day of the roadshow, the company"s management holds a Teach-In for the sales team, which uses the same presentation demonstrated to investors. The briefing enhances the marketing efficiency of the sales people.

After the Teach-In, the company"s management team and investment bankers head to meetings with investors taking with them printed copies of the Information Memorandum.

5. Management roadshow

Depending on the deal structure, the roadshow geography may vary. With an IPO that is marketed to international investors, the roadshow usually takes place in the world"s main financial centres, including Moscow, London, Frankfurt, Zurich, Geneva, Stockholm, Helsinki, New York, Boston, lasting for approximately two weeks.

The roadshow geography may also be adapted to the requirements of the issuer"s specific industry and the deal structure. For instance, the roadshow geography of a Technology company"s IPO and an offering of a Consumer & Retail company may differ. Multiple top management teams may work on a large-scale IPO рwhich allows covering more cities and investors within a limited time frame (Vienna, Paris, Amsterdam/Rotterdam in Europe and Chicago, Los Angeles, San Francisco, Washington DC in the US may be added to the roadshow schedule).

Meetings with investors are held in three main formats: 1) group meetings with a large number of investors in Moscow and other major financial centres of the world (London, New York), or meetings with small groups in other cities; 2) one-on-one meetings with key institutional investors; and 3) conference calls held with investors who cannot attend the roadshow meetings or with regional investors who do not have roadshow meetings at their location.

A meeting usually takes 45 minutes; the management team starts with a formal presentation and then answers the investors' questions. Depending on the level of an investor"s knowledge about the issuer and the deal, the meeting format can more closely resemble a Q&A session.

Usually in the course of a day, five to six meetings are held with minimal intervals in between. The roadshow allows the company"s management to interact with the broadest investor base possible taking into account the deal structure and to obtain the highest demand for the securities offered. The management must highlight the company"s strong points, but also address investor concerns via post pre-deal investor education by research analysts equipped to solve these issues. A successful management roadshow can ensure maximum demand, thus contributing to a favourable price and stable aftermarket performance.

After each meeting, the sales people of the Underwriters contact the investors to receive an order to participate in the IPO if there is an interest, to receive feedback on the management team"s presentation, and to answer additional questions.

6. Marketing to retail investors

If the deal structure includes a retail tranche, then special marketing activities aimed at attracting demand on behalf of those investors may take place. Using retail broker branch networks may prove effective for informing interested private individuals about the deal details and give them access to the share offering by means of a retail tranche. An additional marketing campaign may take place, including interviews to the mass media by the company"s management, a deal information booklet is distributed at the retail brokers" offices, and a multichannel hotline addressing retail investors" questions may be set up.

7. IPO price setting. results press release and the final information memorandum distribution

On the last day of a roadshow, the Underwriters hold a meeting with the company"s management team with the aim of setting the offering price, which will depend on the results of the bookbuilding.

A company press release serves as the official confirmation to investors that the IPO price has been set and the offering successfully completed. Besides the price, the press release also includes details of the offering.

After publication of the press release on the IPO investor who have received an allocation are sent the Final Information Memorandum, which includes the IPO price, the number of shares sold, and the offer size.