"The marketing process culminates in book building ? creating an order book – which ultimately sets the IPO price based on investor demand, on one hand, and the expectations of the issuer (and/or of a selling shareholder), on the other"

PART 2. BOOK BUILDING AND PRICE PERFORMANCE

Chapter 1. Institutional Bookbuilding

Building up a "book" of investor"s orders (bookbuilding) is carried out by the banks organising the IPO process (bookrunners) and usually goes in parallel with management roadshow, i.e. a duration of approximately two weeks. There is also an alternative approach, when bookbuilding starts several days after commencement of the roadshow in order to take into account investor feedback received in the first days of the roadshow before setting a price range. Based on the price range published in a press-release at the roadshow launch, investors are invited to place orders for participation in the IPO.

Orders from institutional investors during bookbuilding, can be of two types: (i) reflecting the desired number of shares, or (ii) the amount of cash to be spent for the shares. Investor can specify an acceptable price level, or otherwise an order is considered unlimited (meaning any price within the announced price range would be satisfactory for the investor). An order can also indicate an intention to purchase various amount of shares at various price levels (within the price range), or various types of stock, i.e. shares or depositary receipts (DRs).

Investors can change the parameters of their orders during the bookbuilding period until the book is closed. In fact, investors can recall their orders at any time and are expected to purchase the stock in accordance with their order only after confirmation of the received allocation on the day of IPO price announcement. In the event of a successful placement, demand from quality investors in the order book is not less and often higher than the planned offer size. Accordingly, allocations to individual investors will then be lower than the submitted orders.

| Investors | Order | Factor | Limit (RUB) | Demand at various prices (RUB) | |||

|---|---|---|---|---|---|---|---|

| 100 | 110 | 120 | 130 | ||||

| Investor 1 | 500,000 | RUB | 110 | 500,000 | 500,000 | 0 | 0 |

| Investor 2 | 1,100,000 | RUB | 130 | 1,100,000 | 1,100,000 | 1,100,000 | 1,100,000 |

| Investor 3 | 30,000 | Share | 120 | 3,000,000 | 3,300,000 | 3,600,000 | 0 |

| Investor 4 | 20,000 or 10,000 | Share | 110, 120 | 2,000,000 | 2,200,000 | 1,200,000 | 0 |

| Investor 5 | 900,000 | RUB | Unlimited | 900,000 | 900,000 | 900,000 | 900,000 |

| Investor 6 | 30,000 | Share | Unlimited | 3,000,000 | 3,300,000 | 3,600,000 | 3,900,000 |

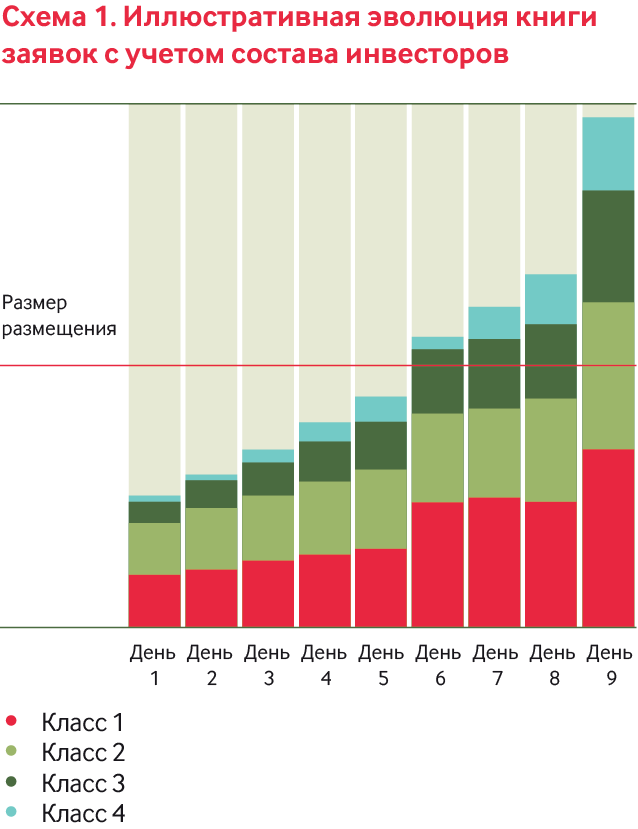

During bookbuilding the bookrunners ccumulate investor demand for the issuer"s stock and analyse the composition of the order book. This process is illustrated on Chart 1. The orders tend to be submitted into the book during bookbuilding unevenly: investors often prefer to use the first week of the process to conduct their own internal analysis and valuation of the issuer and do not rush to place orders. The highest level of investor activity often occurs within the last several days, and, especially, the final hours of bookbuilding. During the process bookrunners regularly inform the issuer and/or selling shareholder(s) on the level of the book coverage.

As soon as the book is fully covered, bookrunners relay the message to the market. A message can also be relayed to the market when the bookbuilding period is nearing completion in order to let investors know that the book is close to being covered as a teaser to motivate them to submit orders.

In some cases the price range can be tightened during bookbuilding to provide the market with more distinct price guidance and to stimulate wait-and-see investors to submit orders. A decision about price-range adjustment can be made by bookrunners with the consent of the issuer after analysis of the book and the demand levels at various prices within the initial price range.

Upon completion of the roadshow and bookbuilding , bookrunners give their recommendation on what the final offer price should be, based on the book of collected orders and prevailing market conditions. The aim is to create a backdrop for a positive aftermarket performance of the stock by balancing the interests of the stock seller and investors.

Positive share-price performance in the aftermarket is facilitated by both a reasonable offer price and not fully meeting investor demand. The latter happens in the event of significant oversubscription. However, it is also important not to cross the minimum acceptable level of stock allocations for individual investors, as this can otherwise have a reverse effect, with investors selling their allocated stocks in case the acquired share blocks are smaller than what they generally manage.

An important factor to consider when setting an offer price and allocations is the mix of investors to receive shares of the Company at the IPO – this will have a direct impact on share price performance and trading liquidity in the aftermarket.

Allocations are carried out by bookrunners, which then provide their respective recommendation to the issuer. Key allocations criteria include: 1) high quality of investor; 2) diversity of investor base; and 3) significant participation of investors who plan to hold the shares long term.

The allocation strategy should factor in both qualitative and quantitative criteria:

- The quality of investors, reflected in their level of sophistication and length of investment horizon coupled with size of assets under management;

- The level of interest in the offering is recognised by: 1) active participation in the meetings during marketing (e.g. during investor education and roadshow), 2) the amount of work done to understand and evaluate the investment case, 3) investments in comparable companies, 4) the order size in comparison to the average position in a stock typical for this investor, 5) expected or expressed strategy towards future holding / buying the stock being placed, and 6) typical investor behaviour after similar placements.

To facilitate analysis of the order book and allocations from a technical standpoint, bookrunners categorise investors depending on the evaluated characteristics.

Investor categories

| Tier 1 |

|

| Tier 2 |

|

| Tier 3 |

|

| Tier 4 |

|

Top-30 institutional investors in shares/DRs of Russian Companies1

| 1 | Aberdeen Asset Managers Ltd. |

| 2 | Alfred Berg Kapitalforvaltning AB |

| 3 | APG Asset Management NV |

| 4 | Baring Asset Management Ltd. |

| 5 | BlackRock Advisors (UK) Ltd. |

| 6 | BlackRock Fund Advisors |

| 7 | BlackRock Investment Management (UK) Ltd. |

| 8 | Capital Research & Management Co. (Global Investors) |

| 9 | Capital Research & Management Co. (World Investors) |

| 10 | Deutsche Asset & Wealth Management Investment GmbH |

| 11 | Dimensional Fund Advisors LP |

| 12 | East Capital AB |

| 13 | Gazprombank OJSC (Investment Management) |

| 14 | Genesis Investment Management LLP |

| 15 | Grantham, Mayo, Van Otterloo & Co. LLC |

| 16 | HSBC Global Asset Management (UK) Ltd. |

| 17 | JPMorgan Asset Management (UK) Ltd. |

| 18 | Lazard Asset Management LLC |

| 19 | Leader CJSC |

| 20 | Mellon Capital Management Corp. |

| 21 | Norges Bank Investment Management |

| 22 | OppenheimerFunds, Inc. |

| 23 | Otkritie Asset Management Ltd. |

| 24 | Pictet Asset Management Ltd. |

| 25 | Sberbank Asset Management CJSC |

| 26 | Schroder Investment Management Ltd. |

| 27 | Swedbank Robur Fonder AB |

| 28 | T. Rowe Price International Ltd. |

| 29 | The Vanguard Group, Inc. |

| 30 | Van Eck Associates Corp. |

Source: LionShares, as of as of May 2015

The table on the left shows the largest institutional investors in shares/DRs of Russian companies, according to publicly available information. Information about IPO participants is confidential. However, this list provides an idea of investors in Russian equities, though it should be noted that these investors could buy stocks both at an IPO and in the aftermarket.

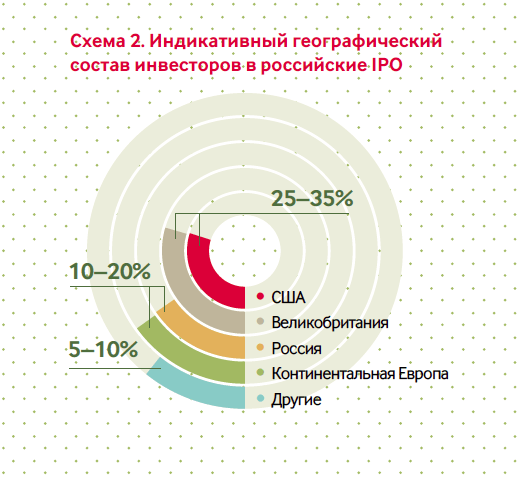

The geographic breakdown of investors can vary significantly subject to industry and business type, but the split often looks like that on Chart 2.

Chapter 2. Retail Bookbuilding

Apart from the option to receive orders directly from institutional investors through sales teams of bookrunners there is also a possibility to collect investor orders via the infrastructure of Moscow Exchange. This instrument is called the "retail tranche", and was first realised in an IPO transaction by Moscow Exchange at its own public offering in February 2013. The instrument has a number of unique features compared to an offering of shares to institutional investors.

- Investor base specifics. Any potential investor can participate in a retail offering provided they have a brokerage account with a licensed broker. In practice, this can be individuals or corporates, or small institutional investors (larger institutional investors usually participate in placements via an OTC offering).

- Settlement and start of trading specifics. Shares purchased in the offering become available to investors simultaneously with the start of trading on the stock exchange on the day of the offer price announcement (while settlement of shares within an OTC tranche may take up to 10 days). On the other hand, all orders submitted via a stock exchange must be pre-funded by investors (the funds are blocked on investors trading accounts for settlement on the morning following the book close). Finally, settlement for the retail tranche has to be made in Russian roubles.

The time frame during which investors can submit orders via Moscow Exchange is announced at the offer launch. Typically, it is the same as the institutional bookbuilding. period. Investors may submit and withdraw orders during certain hours (usually from 10 am to 7 pm Moscow time), which are specified in the announcement of the offer launch, published on the website of Moscow Exchange.

On the evening of the last day of bookbuilding, Moscow Exchange after checking the orders collected and duly prefunded provides the company and bookrunners with information on the number of orders received and the value of the respective demand. Thus, the syndicate acquires information on the total investor demand in the IPO.

The syndicate usually determines in advance what proportion of the IPO the retail tranche will constitute (depending on the issuer"s approach, but usually not more than 15%). If by the end of the last day of of bookbuilding the value of the collected retail orders is lower, they will be fully allocated, while the rest of the shares locked for the retail tranche will be additionally allocated to OTC investors. bookrunners use an allocation strategy in case actual retail demand is higher than initially contemplated (more often than not, proportional allocation approach is used). Issuers can also set a limit above which the orders would be allocated not automatically, but case by case, with a possibility of variations (e.g. RUB30 million).

Chapter 3. Aftermarket Share Price Performance and Stabilisation

Typically, the first day of trading is characterised with the formation of the initial return (which is the difference between the closing price and the IPO price), as a result of underpricing of shares at IPO.

Apart from the underpricing, the share price performance is impacted by a number of other factors.

A. Factors directly connected with an offering:

- Sufficient level of oversubscription and allowance for price sensitivity of investors;

- Optimal distribution of shares (i.e. allocations not taking into account sufficiently the quality of investors and/or their expectations with respect to size of the received block of shares).

B. Economic, market, regulatory and other factors:

- Macroeconomic situation generally;

- Share price performance of comparable companies, situation in the sector;

- Changes of legal framework and regulation;

- Equity markets performance in the US, Western Europe and Russia;

- Newsflow around the issuer.

To support share price performance post IPO, in accordance with international practice, mechanism of stabilization is used. Investors consider this mechanism to be an important "safety cushion" and expect it to be an element of the offering structure. Generally, stabilization is an over-allotment option, or greenshoe, embedded into offering structure. Greenshoe provides syndicate of bookrunners bookrunners with possibility to buy additional shares (usually, up to 15% of the offer size) at IPO price within a 30-day period since start of share trading. The option allows bookrunners to allocate up to 115% of the respective offer size at IPO, which creates a significant short position for the syndicate. Syndicate borrows the over-allotted shares from the issuer or its shareholder.

In case of share price appreciation post IPO, shares are not purchased from the market, and the full IPO size is higher than base one for the size of greenshoe (i.e. for 15%). Syndicate's short position can be covered by execution of a call option (option to buy shares), received by bookrunners from the company or shareholder(s). Syndicate transfers the money received from sale of the additional shares to the issuer or selling shareholder(s).

If share price starts to show negative performance post IPO, stabilizing manager (bookrunner, responsible for stabilization on behalf of the syndicate) can purchase shares from the market at IPO price or below (depending on stabilizing strategy) during the whole period of stabilization until the greenshoe size is exhausted. The purchased shares will allow syndicate to close short position. In this case offering size will be 100% (option is not exercised, all additional shares purchased from the market) to less than 115% (partially exercised option).

Investors do not have considerable preferences with regard to source of shares for greenshoe. This can be either primary (i.e. newly issued) or secondary (existing) shares. From structuring standpoint the latter option is easier to execute. Also, additional share capital raised should preferably be part of the base, and not optional part of offer size.

Alternative less popular mechanisms of stabilization are used as well, such as e.g. brownshoe. Brownshoe is structured using put option: stabilizing manager receives an option to sell shares purchased from the market to a subsidiary company or special purpose vehicle.

In Russian practice stabilization for the offerings of ordinary shares was included in the offering structure for the first time comparatively recently – in 2012 (with no practical execution for IPO of MegaFon and with actual support of share price in the aftermarket of Moscow Exchange IPO), and it has been used since long time by international placements of Russian issuers.

- Source: Lionshares, as of February 2016