"If an issuer wants to achieve business targets, he/she may resort to such instrument as market making, which gives the opportunity to boost the efficiency of listed securities as a means of attracting capital"

PART 2. MARKET MAKING PROGRAMMES: RUSSIA EXPERIENCE

Chapter 1. Introduction

An initial public offering (IPO) does not mean the life of stocks ends; on the contrary, their life only starts, just like the life of man after birth. A child"s destiny does not fully depend on natural abilities. Similarly, the success of an IPO will not fully determine the destiny of the stocks. Sometimes stocks are listed near the top of a price range, enjoy investor demand and the bidding book is oversubscribed, only for later to see their reputation become tarnished and their price slump. That has an adverse effect on a company"s capitalisation and its opportunities to raise capital for development through secondary offerings and borrowings. To avoid this, it is important that the business of a listed company is successful and that its shares meet the needs of market participants.

For traders that do not focus on long-term stock ownership and who like to benefit from speculative trading such factors as the company"s dividend policy and its business growth are only of secondary importance. They focus on liquidity, or, to put it simply, the possibility to quickly buy or sell an asset at any time without paying a considerable premium when buying and without offering a significant discount when selling.

The key liquidity indicators of a security are the average daily trading volume and the bid-ask spread – the difference between the best bid price for a security and the best ask (or offer) price. Larger average daily trading volumes and smaller spreads result in higher liquidity.

Most private investors tend to actively deal with a limited number of stocks and are not in a rush to buy stocks of new issuers until they have earned a reputation of being liquid assets. Meanwhile, some IPO participants attracted by an active marketing campaign may not be very aware of the actual market reality. As they see no rapid growth in newly-listed stocks, they may rush into selling them. And if there is no respective demand, the share price will plunge, and many sellers will fail to find buyers. This sequence of events does not contribute to success of the stocks on the market.

Owing to this, most companies, excluding the biggest ones and well-known business giants, need support straight after entering markets, just like people, when their life has just started, need support until they become strong enough. It is market makers that help them to gain strength. Their main goal is to maintain trading volumes and appropriate for the market. As a rule, official market makers are hired by stock exchanges or security issuers. They sign agreements featuring stipulated terms and conditions, specifying the spread, the period when a market maker shall undertake to maintain two-way quotations, and the bidding volume.

The reputation of stocks is built up during an IPO and when the stocks start to be listed, and can be difficult to change afterwards. For this reason, issuers who would like their stocks to become highly liquid are advised to hire a market maker in advance during the preparation for a listing. This may be one of the companies that organises or helps organize the listing.

Chapter 2. Functions of Market makers

The market makers" key goals and which are related to all other tasks are to make stocks liquid and prevent sharp price movements within given periods of time. This is achieved through balancing the supply and demand of an asset: when most of the market participants start to sell it.

Hence, a market maker partly assumes risks, for instance, when stocks moves sharply for fundamental reasons (when a business expands considerably or collapses). Market makers activities are beneficial not only for the issuer, but also for the stock exchange, as they stabilize trading and allow investors to conduct asset-related operations at any time.

Alongside ensuring two-way quotations, appropriate for market participants, a market maker may agree with an issuer and the stock exchange upon the provision of all-in-one information and consulting support. For instance, a market maker may initiate complex measures aimed at creating better interaction between management of the issuer and the investment community. This may include offline and online events to inform investors about possible ways of working with an asset, to help disseminate information about a company"s activities among market participants and potential investors and to provide issuers with analytical support.

Chapter 3. Conditions Related to Market Making Services

Under the admission to trading rules of CJSC "MICEX Stock Exchange", market participants may acquire the status of official market maker for a certain stock admitted to trading on Moscow Exchange.

For market makers to provide its services a tripartite agreement must be signed with it an issuer and Moscow Exchange. An important advantage for an issuer when dealing with a market maker on Moscow Exchange is the manner of settlement under agreements: if a market maker does not fully fulfil at least one of the requirements to maintain quotations, as specified in the agreement, the issuer will not pay for the market makers" services within that period. Under a tripartite agreement, Moscow Exchange is responsible to ensure a market maker meet its obligations to an issuer, and after the end of the reporting period provides the issuer and market maker with respective reports.

The market maker"s obligations are stipulated in the agreement with an issuer and Moscow Exchange, as well as in the Guidelines on Manner, Terms and Conditions of Maintaining Prices and Demand for, Supply and Volumes of Trading in a Financial Instrument, Foreign Currency or (and) a Good ratified with the FFMS under Order No. 11-2/pz-n dated 21 January 2011. The obligations include maintaining the spread for a stock within a certain range, as well as the volume of bids of one and the same direction at a level not less than the minimum allowable volume. For instance, for the Innovation and Investment Market of Moscow Exchange, the spread of newly-listed stocks tends to total 3-5%. The volume of bids regarding certain stocks varies, depending of the price of the issuer"s securities. The agreement separately stipulates the minimum allowable volumes of securities (MAVS) and the sufficient transaction volume (STV). These parameters are measured in the number of securities (pcs).

The tripartite agreement also stipulates the term, during which a market maker is entitled to maintain two-sided quotations within a trading session. This indicator is measured in minutes and may total 70% of the trading session.

Agreements last for various periods of time. As a rule, initially an agreement is signed for 6 or 12 months with the possibility of prolongation, so that the parties may decide afterwards if they need to support the stock or not.

Chapter 4. Business Practice Implementing Market Making Programmes

We examine several examples of market making programmes and their impact on the liquidity of stocks traded on Moscow Exchange.

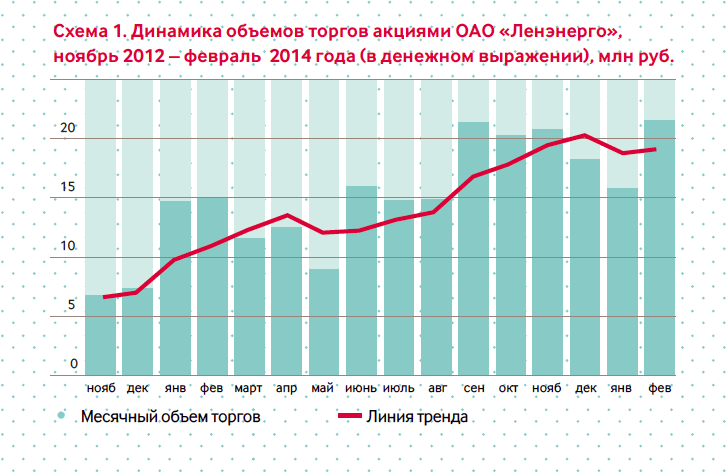

November 2012 saw the launch of a market making programme for common shares of Lenenergo OJSC, one of Russia"s largest electricity distribution companies which operates the electricity network in St. Petersburg and the Leningrad Region. Energocapital Investment Company CJSC acted as market maker. The brokerage initiated a market making programme, for common shares of Lenenergo, which included containing the maximum allowable spread of two-way quotations at 5%. MAVS stood at 30,000 pcs, while STV equalled 100,000 pcs.

It is noteworthy that this market making programme helped increase the average daily trading volume in Lenenergo OJSC securities by 180.64%. The reading totalled 291,837 shares against 103,987 shares prior to signing the market making agreement.

Market making support for the common stock of Kuzbasskaya Toplivnaya Company OJSC (KTK OJSC) and Levenguk OJSC yielded even more impressive results. The programme was carried out by Investment Company Finam, CJSC. The intraday trading volume of KTK OJSC skyrocketed by 1,427.52% (to 31, 864 shares), while the volumes for Levenguk OJSC jumped by 510.53% (to 65,306 shares). On average, the market maker initiated 50-70% of the intraday transactions of these two companies" securities on Moscow Exchange.

Hence, market making programmes do help issuers to substantially increase their liquidity.

Conclusion

If an issuer wants to achieve its business goals, it should prepare in advance for an IPO and utilise the advantages of using a market maker a strategy that will enhance the attractiveness of a company"s shares for investors. There is a favourable backdrop currently available to utilise this strategy created by the organiser of trading, namely Moscow Exchange, and the regulator of the securities market, the Bank of Russia. These entities have established the necessary legal and regulatory framework for the provision of this service. In addition, an experienced group of securities market professionals have emerged who specialise in market making, including those optimised for the securities of new issuers.